This is part 9 of our Landlord’s guide to Tenant Screening. If you’ve landed here directly don’t worry — we cover the 5 warning signs of tenant screening services below.

There Are Hundreds Of Tenant Screening Services

With so many options for tenant screening services out there, it can feel dizzying trying to figure out which one is the right fit.

That’s why we’re going to identify 5 common issues that you should be aware of when vetting a tenant screening service.

When breaking down the 5 most common problems, it’s important to understand that if there is one universal truth, it’s this: every landlord’s needs are different.

In other words, there is not one perfect solution and opinions vary greatly from one landlord to another.

Below is a list of the 5 problems we will address in this post.

A table of contents for issues with tenant screening services

- Instant Data Comes With Instant Errors

- Compliance Issues

- Tenant Involvement

- Eviction Data Issues

- Customer Support Outsourcing

But… before we get started, let’s address this simple question.

What is a tenant screening service?

Tenant screening services are consumer reporting agencies (CRAs) that provide background data on tenant applicants. The data can include bankruptcies, judgments, liens, credit reports, sex offender status, criminal history, eviction history and employment verifications. The reports these screening services provide help to give a landlord a clearer picture of their tenant applicant before deciding whom to choose for their rentals.

Now let’s get to the issues that commonly plague tenant screening services.

#1. Instant Data Comes With Instant Errors

It’s been proven time and again, like in this Princeton Study, that people tend to choose instant gratification over sound decision-making.

Professor David Laibson, of Harvard University says this about these findings:

“Our emotional brain has a hard time imagining the future, even though our logical brain clearly sees the future consequences of our current actions. Our emotional brain wants to max out the credit card, order dessert and smoke a cigarette. Our logical brain knows we should save for retirement, go for a jog and quit smoking.”

What does this have to do with tenant screening?

Most tenant screening services are built to maximize profits. This means satisfying the emotional brain that wants immediate gratification.

Many services offer instant background checks and, because landlords don’t have a frame of reference for background checks, they will choose the instant service because it appeals strongly to the part of the brain that wants to max out the credit cards.

A Frame Of Reference For Tenant Screening Services

Instant background services are nothing more than software platforms that ping databases to copy/paste information into a report.

There are two major downsides to this method:

- Some databases don’t allow for instantaneous searches.

- There are errors and false positives in every database.

If you go with an instant solution, your report is created with less data.

Your report is a mirror image of what’s in the database it pulls from. If that database has errors, they will show up on your report as well. This means that some important information may be omitted, while false data may be included since there is no system in place to double check the work.

Databases, by nature, have errors. If no one spot checks the information, those errors go on the credit report and/or background check.

The Solution: Hand-Compiled Reports

We can’t speak for every service but, here at RentPrep, we take about an hour to produce each tenant screening report. Rather than providing you with instant, and potentially faulty, information, we manually access databases, hand-compile reports, and fact-check all of our data for compliance. That way, our landlords can be confident they’re getting the most complete and accurate reporting possible.

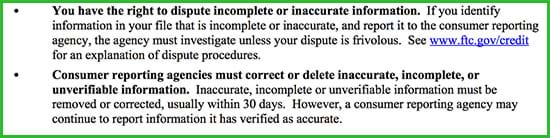

#2 Compliance And The FCRA

There are laws laid out in the Fair Credit Reporting Act (FCRA) to highlight the rights of a person who is having a background check run on them. In the case of tenant screening, FCRA protects the rights of the tenant applicant.

Under FCRA, potential tenants have the right to dispute any perceived inaccuracies in their reports. Unfortunately, this complicates matters for landlords who are screening these renters because it can sometimes be difficult to track down the right person at a tenant screening service to fix the inaccurate information. If you’re unable to get in touch with someone, your recently denied tenant applicant will probably have trouble, too.

Pro Tip: Research the tenant screening services you’re considering using and see if they have a phone number readily available. Try calling it and see what happens. This will be a good indicator of what their customer support is like. Other things to be aware of when it comes to the FCRA and screening tenant applicants:

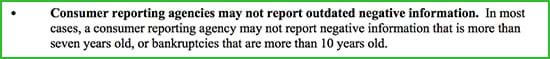

FCRA also dictates that consumer reporting agencies cannot report any negative information that is outdated. For example, a landlord cannot use an eviction from eight years ago as a reason for denying a tenant applicant.

A majority of tenant screening services, particularly those who provide instant reporting, do not use FCRA Certified Screeners to run their background reports, so the information on their reports is often not in compliance with this standard. This is why we hire and train FCRA Certified Screeners to only include reportable data in a tenant background report.

Many landlords want to know everything possible about their applicant, which is understandable, but we advise these landlords to stay compliant with FCRA.

Consumer reporting agencies, like tenant screening services, or furnishers of information, like landlords, can be sued in state or federal courts for violating FCRA. Compliance within the FCRA with your screening is crucial for the screening service AND you as a landlord.

Pro Tip: If you’re searching for “tenant screening services” on Google, try amending your search to something like “FCRA tenant screening services” to make sure the services that you check out use FCRA Certified Screeners.

#3 Tenant Involvement Varies By Screening Service

Some landlords don’t mind if the tenant is involved in the screening process while others avoid it completely.

What does “tenant involvement” mean?

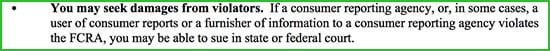

Some services, such as our TransUnion reports, require that the landlord provide the tenant applicant’s email address. At that point, the applicant is sent an email with a link to be taken through a process to provide their personal information, verify their identity, and pay for the report. Here’s a screenshot of what the three-step process looks like on the potential renter’s end:

This is an added hurdle that is not part of the tenant screening process with a “zero tenant involvement” service. Some landlords don’t like slowing the process down by involving the tenant. They’ll charge an application fee and then run the reports themselves without tenant involvement. Other landlords don’t mind the tenant being involved because, if they can’t complete the background check, they might not be a good tenant anyways.

#4 Eviction Data Issues

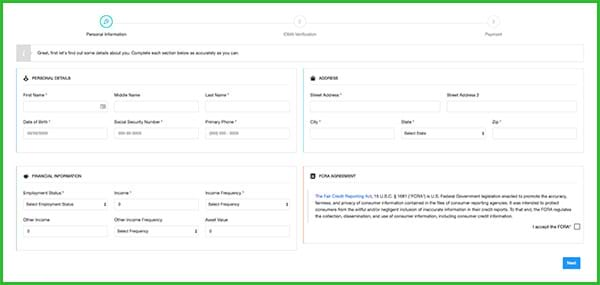

Eviction data is the most telling information in any tenant background check. Just look at this data from TransUnion on previously evicted tenants.

The chances of a previously evicted renter going through another eviction are almost three times higher than if the person has never been evicted before.

While we at RentPrep believe that the most important data should be included in the most basic level of the background report, some tenant screening services don’t include eviction data in their basic packages. Any tenant screening company not including eviction data on any of the reports does not have the best interest of the landlord in mind.

There are a lot of tenant screening services out there, and some offer an upsell for nationwide searches. This should be a red flag to landlords for two reasons.

#1 – People are more transient than ever. It’s not uncommon to get an applicant who has lived outside of your state. Landlords should be able to see if their potential tenants have criminal or eviction records in another state.

#2 – The cost isn’t substantial. A tenant screening company has costs associated with accessing the different databases they use to compile your reports and the cost between a statewide eviction search and a national eviction search is pennies more. However, some screening services use that as an opportunity to make more money. Many times, tenant screening services will charge $10 more to add nationwide searches – a markup of 50-100x depending on the search.

Eviction Judgments vs. Eviction Filings

As mentioned earlier, some databases don’t allow “instantaneous data extraction.” In other words, they won’t connect with instant background services and instead require a person to parse through the data. Instant eviction databases will show you eviction judgments when a court sides with the landlord in an eviction case, but they won’t show you eviction filings.

An eviction filing often happens when a tenant lives in a property that is managed by a professional property management firm. Many property managers will have a policy in place to begin the eviction process when rent is a certain number of days past due. The tenant gets that notification and ends up paying the rent, including any late fees. Technically, this results in an eviction filing with the courts that has been dropped when the tenant pays their outstanding rent.

Here at RentPrep, we find this data valuable because it gives you a clearer picture of your tenant applicant. If a potential renter has 13 eviction filings but no eviction judgments, you might be looking at an applicant that always pays late on rent. Instant background searches will not go into this level of detail because it requires a person to hand-compile that data.

Pro Tip: Other advantages of hand-compiled reports include issues with matching names or other identifying information. Sometimes instant services will have issues with common names. Plus, if a landlord inputs a SSN wrong by one digit it could reset the entire process or even charge you for a blank report. Our screeners look for that and will call you to get the information correct before running your report.

#5 Customer Support Can Be Questionable

When RentPrep first started, there were very few tenant screening services. Now, thanks to the advent of APIs, there are hundreds. There’s nothing wrong with this. In fact, we offer a tenant screening API through RentPrep. The problem occurs when the developer doesn’t account for customer service. Beyond not being able to get your personal questions answered, you’re also creating a potential issue with a denied applicant. Under the laws of the Fair Credit Reporting Act, a tenant applicant is afforded the right to see a copy of their background report. It is your screening service’s duty to provide that report, but personally sharing your report with the denied applicant could open you up to liability.

This is where having great customer support comes in handy. If you use a service such as RentPrep, you just give them our phone number and we can handle a denied applicant seeking their report. We’re open 7 days a week and reachable by phone, email and Live Chat.

We answer calls every day from denied applicants that want to see a copy of their background report. Often, there is negative information on these reports that the applicant is unaware of. When it comes to a tenant screening service you want your report to take a little bit of time but support to be lightning quick. This rule of thumb can save you from a lot of heartache. If you’re confused on which service is best for you, consider reading our tenant screening reviews post which breaks down 11 services and separates them into four different categories.

For an overview of problems with tenant screening services, check out this video:

Parting Thoughts…

Which tenant screening service a landlord partners with really comes down to what your preferences are. At RentPrep, we’re big believers in hand-compiling screening reports. However, some landlords prefer to see a full credit report and have the tenant be able to pay for it directly. If you still have questions, our packages page details exactly what our different screening reports provide.

If you have a question during business hours (we’re open 55+ hours a week), you can call to chat with one of our FCRA Certified Screeners at 1 (888) 877-8501. You can also Live Chat with one of our screeners during office hours. We’re here to help you through the entire process of finding that perfect renter.