Updated November 2021

When talking to experienced landlords, you might hear them mention using a rent income ratio calculator as part of their tenant screening process. This tool makes it easy to ensure that in addition to being a reliable tenant, the individual also makes enough to afford the cost of rent each month.

No matter how much you like a potential tenant, there is no reason to rent to them if they are not going to be able to afford to pay their rent. Checking if their income fits an appropriate rent to income ratio is a great, straightforward way to handle this.

What exactly is the best rent to income ratio standard, and how can you responsibly apply this to your rental business? Learn more with us today.

Rent Income Ratio Calculator Table Of Contents

Though using an income to rent calculator is a common technique within the rental industry, not all landlords know how this can be helpful. Find out why landlords like this method and how to use it most effectively:

- What Is A Rent To Income Ratio?

- RentPrep’s Rent Income Ratio Calculators

- How Landlords Can Use This Information

- Income To Rent Ratio Calculator FAQs

- What is a good income to rent ratio?

- How do you calculate if a tenant can afford the rent?

- How to calculate the rent based on income?

- What is 3 times the rent, and why does it matter?

- How do apartments calculate gross income?

- Do you have to make 3 times the rent to get an apartment?

- What does a 30% rule equate to in a rent-to-income multiplier?

- Do I Have To Apply Income Ratios?

What Is A Rent To Income Ratio?

A rent to income ratio is a standard set up by the landlord for their rental property. This standard sets a threshold of gross income that the landlord wants to be met in order for an applicant to be considered for the rental property.

Often, this type of ratio is also known as an income to rent ratio, but the order of the terminology isn’t that important. What is important is that you understand what numbers you should be considering.

This ratio compares a prospective tenant’s annual income with the cost of rent at your property. By comparing these numbers, you can see what percentage of a tenant’s income would be needed to cover rent. If that percentage is too high, there’s a good chance that a tenant wouldn’t be able to afford rent long-term. At the very least, the risk of renting to them would be higher than to a tenant with a more appropriate income.

Why Do Landlords Use 3 Times Rent Calculator And Similar Ratios?

Why would it be helpful for landlords to have a standard ratio to use when screening tenants?

Many landlords feel that it is best to rent to tenants who make at least 3 times more than they would be paying in rent. This is to ensure they can keep up with their other living costs in addition to rent.

By using income verification as a part of tenant screening, landlords can help to prevent under-qualified tenants from renting beyond their means, which helps both parties in the long run. The rent to income ratio is just a way to simplify these calculations so that you can determine an applicant’s eligibility more quickly.

RentPrep’s Rent Income Ratio Calculators

Here at RentPrep, we have developed a few different tools surrounding income to rent ratios for landlords like you to use. Each of these tools differs slightly, but the end product should always help you make the proper selection when tenant screening.

Rent To Income Ratio: Based On Percentage

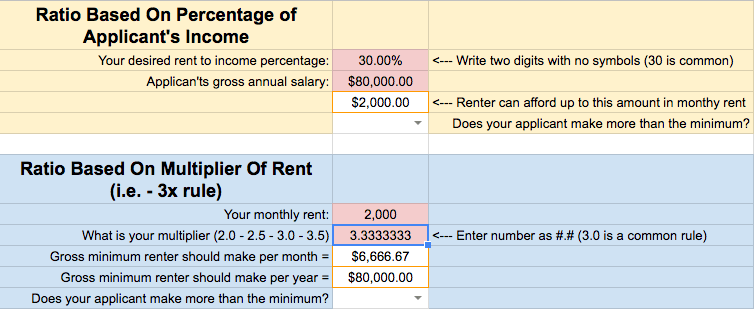

This calculator bases the ratio on the percentage of the applicant’s income that the rent would be.

In this calculation, the final output is the maximum rent that someone can afford based on their salary. A 30% rent to income ratio is a very common standard for landlords to use, but you can adjust this standard to fit the area in which you are working. For example, in some areas, higher rent to income ratios, even as high as 70%, are common.

Rent To Income Ratio: Income Multiplier

RentPrep offers a service called SmartMove Report. This product uses a ratio based on the multiplier below to recommend the right tenant:

The multiplier used in this calculator demonstrates that the tenant makes enough income to afford your rent. If you want a tenant to make at least 2.5 times the monthly rent, you will use the 2.5 multiplier, and so on. Many landlords use the 3x multiplier, but you will need to determine what multiplier fits your rental business.

The calculators above are handy tools for quickly figuring things out. Consider bookmarking this page for future use might be a good idea.

Spreadsheet Resources (Including Templates)

In addition to the above, we’ve also created a Google Sheet and an Excel spreadsheet that include these calculators in another format for you to use.

We’ve created a video to accompany these spreadsheets, and you can download for your own use as well.

Click here for the Google Sheet

Click here for the Excel sheet

Easy Mental Math For Rent To Income Ratio

Finally, you might be the kind of landlord who prefers to be able to do these calculations on the fly. Not everyone wants to be referencing an online calculator or spreadsheet when they’re doing their screening, and that’s okay.

Here’s all it takes:

- Start with the applicant’s annual salary

- Divide that number by 40

- The result is 30% of their gross monthly salary

By knowing this simple calculation by heart, you will be able to do the calculation at any time for the most a tenant can afford to pay for rent based on a 30% rent to income ratio.

Rent To Income Ratio: Examples

- If a tenant makes $80,000 in gross annual income, you would divide this by 40.

- The resulting number of $2,000 is the most that tenant can afford for monthly rent under a 30% ratio.

Another way of reaching this number might be more clear to some landlords. Here’s another method to achieve the same result:

- Use $80,000 and divide it by 12.

- The resulting number of $6,666.66 represents the gross monthly salary.

- Multiply $6,666.66 by 30% to get $2,000.

How Landlords Can Use This Information

Now that you know how to calculate these ratios, you might be wondering how to implement them as part of your screening process. Using these ratios is a great way to see if a tenant is financially a good fit for your property, and it’s not that difficult to do this.

First things first: make sure that you have set a proper rental price for your rental property. This is key to your success as a landlord, and you must have this figure in mind before you can utilize income rent ratios.

Once you know what you want to charge monthly, you can easily figure out what annual salary a tenant would need in order to meet your rent to income ratio.

For instance, if you want $1,200 in monthly rent. You can multiply that number by 40 to get a minimum gross annual salary. In this example, it would be $48,000.

When you get ready to put your rental listing out there, calculate this number and keep it in mind as you start receiving applications. It might not be necessary to outright deny tenants who do not meet your income preference. Still, you may want to talk with them about these financial concerns to ensure that it would end up being a mutually beneficial relationship.

Rent Income Ratios And Legalities

With the restrictions often placed on what landlords can and cannot use as determining factors when selecting tenants, some landlords may feel wary about using income as part of their screening process.

Is there anything to be worried about?

Probably not. It is likely legal for you to use a rent to income ratio as a screening tactic for your rentals.

However, be aware that there are a lot of factors that can alter a person’s annual income. Things such as SSI or wage garnishments are a couple of examples.

You can check out this HUD article to see what income is included or excluded in rent determinations.

If you find the tenant screening process to be complicated and are worried about legalities, you might benefit from enrolling in a tenant screening service. Services like our tenant screening here at RentPrep help you to make an easy decision about applicants while keeping within all legal bounds. Learn more about RentPrep’s screening here today!

Income To Rent Ratio Calculator FAQs

What is a good income to rent ratio?

In the rental industry, the minimum percentage considered a good ratio is 30%. This means that the rent would take up no more than 30% of a tenant’s monthly income. Landlords who implement income ratios as a standard often use 30% as their minimum income level for potential tenants. Some even include this information in their rental listing to keep under-qualified tenants from wasting their time applying.

Successful landlords take rent to income ratios very seriously because nonpayment of rent is the biggest problem for most rental property owners. Tenants who cannot or won’t pay rent eventually have to be evicted, which is a costly process in both time and money.

To avoid evictions, landlords find that implementing income requirements on their properties to fit the unit, region, and cost is appropriate.

How do you calculate if a tenant can afford the rent?

The most straightforward way to calculate if a tenant can afford rent is to take their annual salary and divide that number by 40. If the amount is more than what you are charging for monthly rent at the rental property, the tenant can afford the rent.

Dividing their annual rent by 40 gives you an approximation equal to 30% of an applicant’s monthly income. This calculation is an easy way to find your answer, but it’s not your only option. Visit the earlier sections of this article to view calculators, spreadsheets, and more tools that can help.

How to calculate the rent based on income?

Applicants, curious tenants, and others might ask you how they can determine what rent they can afford based on their income. If you want to help them gather this information, they would do basically the same calculations you learned about today!

For example, a tenant who makes $56,000 annually could divide their income by 40, leaving them $1,400. Ideally, they wouldn’t want to pay more than this amount in rent each month.

Of course, they can determine if they think they could afford more or not if they have savings, other sources of monthly income, or plans to make more money in the coming months. Regardless, this is the amount that should be recommended.

What is 3 times the rent, and why does it matter?

“3 times the rent” is a method used by many landlords to see if a tenant is making enough income to be able to afford to rent a particular unit. This is why you often see 3 times monthly rent calculators as the most commonly available tool. However, landlords can use any multiplier they find appropriate in their calculations.

For example, landlords renting out a $1,000 per month unit may expect tenants to be bringing in at least $3,000 a month to be able to afford their rent along with other living expenses.

Landlords have found that by ensuring their tenants have the right income for a property, the landlord–tenant relationship is more likely to succeed. Alongside other tenant screening data, landlords often rely on a rent to income comparison to decide which applicant to rent to. It’s critical to verify an applicant’s income for this reason.

How do apartments calculate gross income?

There is no single method used by all apartments, and most will generally accept various income verification methods. For example, you might decide that you are willing to take W-2s from the previous year as long as you also get an employment letter to verify that the applicant still holds that position.

You shouldn’t rely on a gross income method that requires you to do too much guesswork. Instead, ask for applications for either a financial document like their tax paperwork or bank statements from the last few months. Don’t forget to remind tenants that they can and should include any monthly payments they may be receiving, such as alimony or social security benefits.

Do you have to make 3 times the rent to get an apartment?

Tenants often ask this question: Is it a hard rule that I need to make 3 times the rent to get an apartment?

The answer is ultimately up to you as the landlord. A property owner can determine what income they want to require to rent out a unit, which is a perfectly legal way to do business. After all, you as a landlord want to ensure that the tenant will be able to pay rent in the coming months.

However, not all landlords use 3x the rent as their baseline. Some are willing to accept 2x the rent, or even less in cities where housing is costly. The best thing that a curious tenant can do is ask the property manager or landlord if there are income requirements before applying to rent a property.

What does a 30% rule equate to in a rent to income multiplier?

It can be confusing to jump back and forth between the percentage calculators and the multiplier calculators, so it is usually best to stick to one model when setting your standard. However, you might want to learn how to compare the two so you understand what other landlords are using as well.

A 30% rule is the same as a 3.33 (repeating) multiplier ratio.

Here’s a screenshot of those numbers matching up (look at the highlighted box of 3.3333333).

This is important to understand because if you use a 30% rule, then you’re actually being more selective than someone who uses a 3x rule. This is fine, but you want to be sure you understand the difference between using a multiplier and the percentage-based method.

Do I Have To Apply Income Ratios?

As a landlord, you are in no way required to use rent to income ratios as part of your screening process. You can leave it up to tenants to determine if they can or cannot afford rent, and then pursue eviction if they cannot afford rent at any point.

However, many landlords have found that knowing how much a tenant needs to earn to reasonably afford their property can let potential tenants know upfront what income is best for their rental. Some tenants also appreciate this type of warning to help them get into the right property.

In the end, it’s all up to you as the landlord, as long as you are staying within the bounds of all local, state, and federal laws. In our eyes, however, it’s always best to set a clear standard to ensure that you encounter as few eviction situations as possible. After all, you don’t always get to choose your tenants, but when you do, you want to make sure you’re making a good decision.