Tenant Screening Report Samples

We offer two tenant screening reports here at RentPrep:

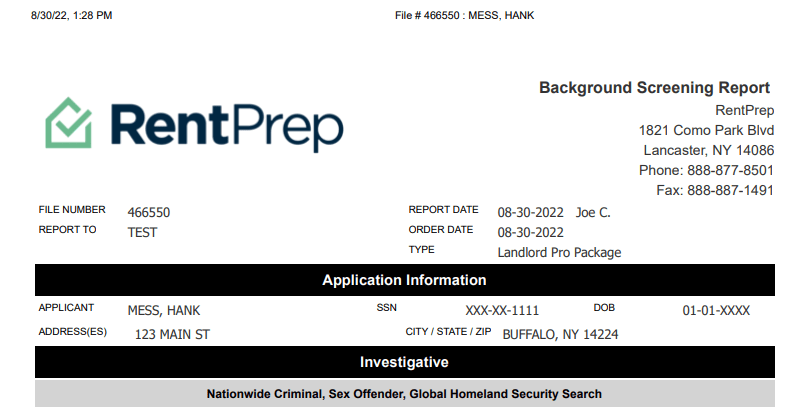

- RentPrep Tenant Screening Report (hand-compiled background check)

- TransUnion Full Credit Report, formerly known as SmartMove (full credit report with score)

Below you can find a sample of both reports by clicking on either image.

TransUnion Full Credit Report

-

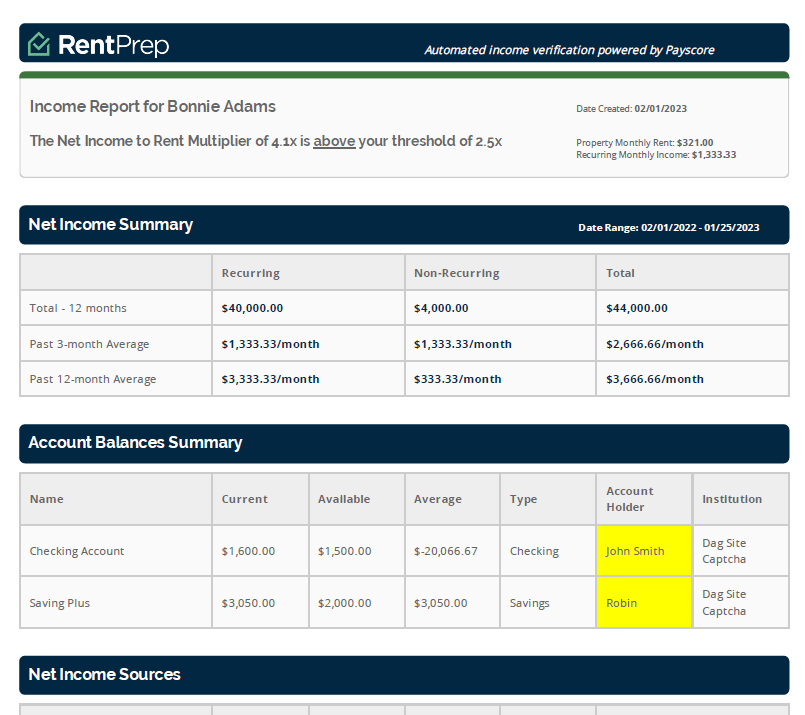

$40 – TransUnion Full Credit Report

- $7.00 – Judgment/Liens Search (optional add-on)

- $10.00 – Income Verification (optional add-on)

A tenant screening report can vary widely.

Many times people don’t realize the difference between a full credit report, a background check and a credit decision report (sometimes referred to as a credit check).

We will cover all of these in detail.

A table of contents for tenant screening reports:

- What is a Tenant Screening Report?

- How Tenant Screening Reports Differ

- Credit Decision Report vs. Full Credit Report

What is a Tenant Screening Report?

A tenant screening report is a look into the history and habits of a tenant applicant. It can provide details about payment history, eviction history, criminal history, and any red flags a landlord would want to know. The purpose of the report is to give you confidence in your final decision on the applicant you select.

How Tenant Screening Reports Differ

Landlords tend to be split when they think of a tenant screening report.

Some think of a credit score or full credit report while others think of background checks.

The TransUnion Full Credit Report, formerly known as SmartMove, is known for providing the credit score but also adding elements of background checks such as eviction records.

The downside to a TransUnion Full Credit Report is that it’s an instant report. This means that the errors and omissions that happen on the court level are carried over into the final screening report.

Our RentPrep package is hand-compiled so our FCRA Certified Screeners can correct inaccuracies by cross-referencing databases. This allows for a more accurate report.

The downside is that we cannot provide the full credit score, but we can add a tenant credit check.

Tenant Credit Report vs. Credit Decision Report

A tenant credit decision report is not the same thing as a tenant credit report.

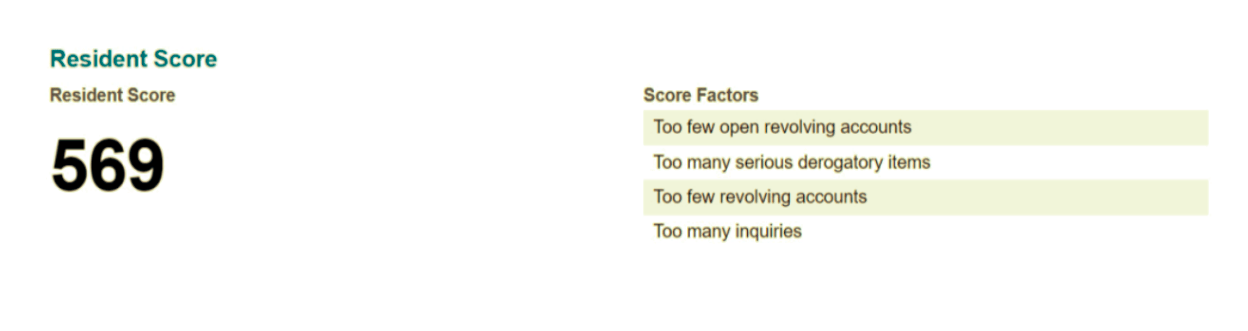

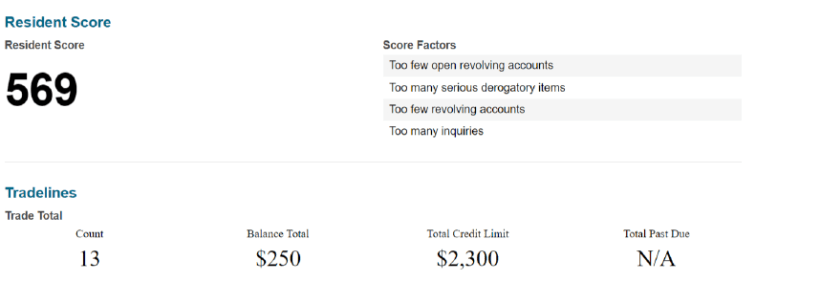

The TransUnion Full Credit report will show you a ResidentScore.

TransUnion ResidentScore

You’ll see the specific credit score of your applicant along with the negative factors contributing to the score.

As you work down the report (see sample above) you’ll see boxes you can expand with details on each of the following data points:

- Credit Score

- Known Addresses

- Known Employment History

- Collections

- Consumer Statements

- Inquiries

- Public Records

- Eviction Records

- Criminal Records

- AKAs

- Tradelines

This tutorial will show you what’s included with a rental background check. It will go into detail on each of those sections of a TransUnion Full Credit report.

Tenant Credit Check Sample

A tenant credit check is a pass/fail report only available as an add-on (for $11.00) to a RentPrep Background Check.

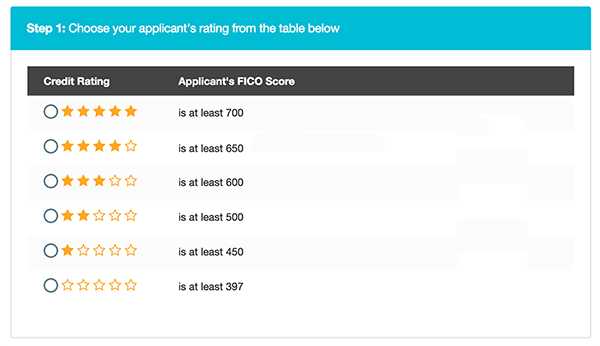

You select a pre-set criteria from the available star options below.

If you chose a 5 Star rating it means that your tenant applicant must have at least a 700 credit score.

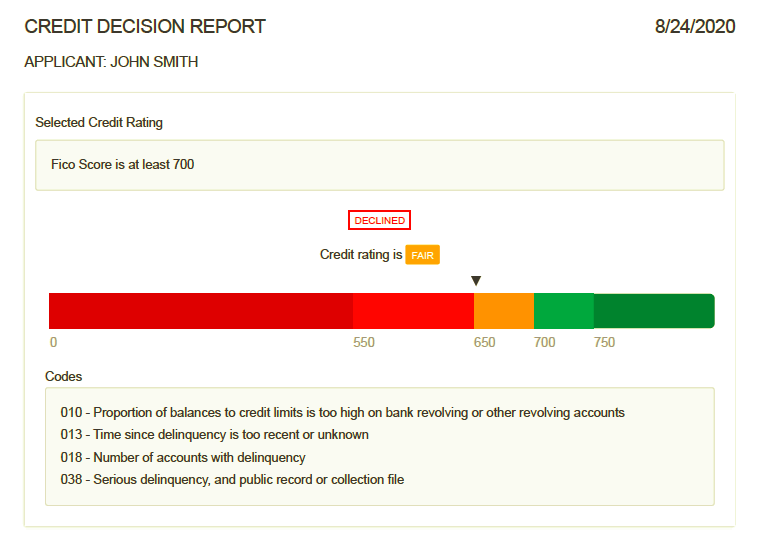

Here’s an example of what it would look like when a tenant applicant fails a 5 Star credit check.

In this example, you see their credit score was less than 700 and you’ll see a list of negative factors that contributed to their score. Notice you do not see the specific score though.

There are no additional details as this a pass/fail metric while a TransUnion Full Credit report will go into specific details of how their credit score was calculated.