According to our records the average renter’s credit score is 649.

However, this number will be changing in the coming months and here’s why.

We recently discussed why an average renter’s credit score is expected to go up 10-20 points due to changes in the three major credit bureaus.

The “National Consumer Assistance Plan” is a project put together by the three credit bureaus of Transunion, Equifax, and Experian. The main purpose is to make credit reports more accurate and easier for consumers to correct any errors they come across on their report.

On July 1st, 2017 credit reports won’t be able to report the same amount of judgements and liens. Here’s a brief synopsis of some of the highlights.

Average Renter’s Credit Score Improving: Changes To Medical Debts

Medical debts will now wait for a 180 waiting period before being reported. This rule’s been created to allow time for insurance payments to be paid.

This new change will also remove from credit reports and previous medical debts that have been or are being paid by insurance.

Just one collections account can cause a 50-100 drop in a credit score.

We also know that 1 in 5 working-age Americans struggles with paying medical debts.

Many times it can be issues associated with going back and forth with insurance. Adding this 180 day grace period is just one reason the average renter’s credit score will be improving.

Average Renter’s Credit Score Improving: Non-contractual debts

The NCAP is also working to eliminate the reporting of debts that did not originate from an agreement or contract by the consumer to pay, such as traffic tickets or fines.

Most debts occur from contractual agreements that are not met:

- Rent Payments

- Mortgage

- Car Payments

These will still be reported but any debt involving traffic violations will not be reported. This should eliminate a small percentage of debts across the board.

RentPrep’s Take On Renters Credit Score

Typically speaking, a homeowners average credit score is around 723. Since a renters credit score is lower, it’s not hard to imagine that they are more likely to have medical debts or debts involving fines.

These changes are more likely to effect a renters average credit score since they may have more dings on their credit.

If you need to run a background report on a prospective tenant and are looking for their credit score, we recommend using our SmartMove product.

If you have questions we’re here to chat as well.

What Should My Minimum Credit Score For A Tenant Applicant Be?

This is up to the landlord and can vary based on your preference, quality of the rental, and location.

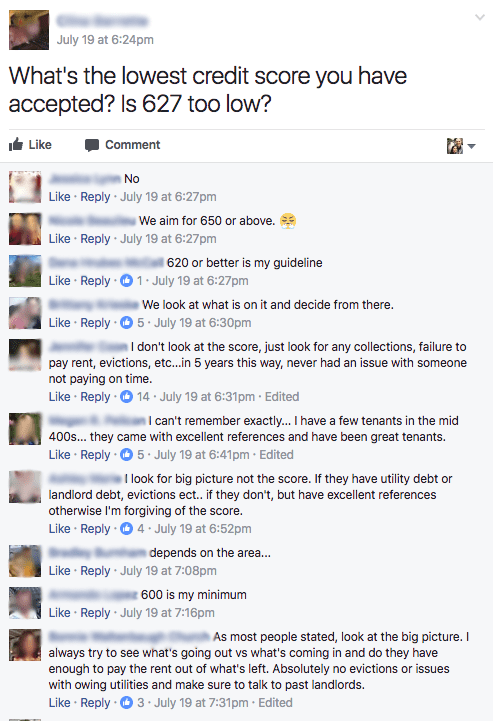

Here’s a screenshot of landlords discussing this question in our private Facebook group for Landlords.

You can see even more comments on that post by checking it out in the group.