Get a tenant credit check without the tenant’s involvement

Here at RentPrep, we have our own tenant credit check that we call a “Credit Decision Report“, powered by TransUnion.

These reports are available as an add-on for $11.00 to a RentPrep Background Check.

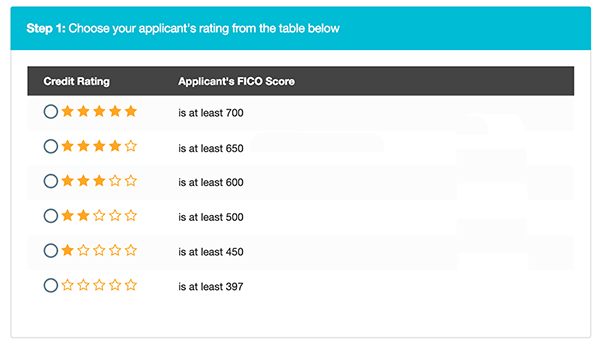

You will select a star rating (0 through 5) that will act as your criteria that the applicant must pass.

A 4-star rating would mean your applicant must have at least a 650 or higher FICO Score.

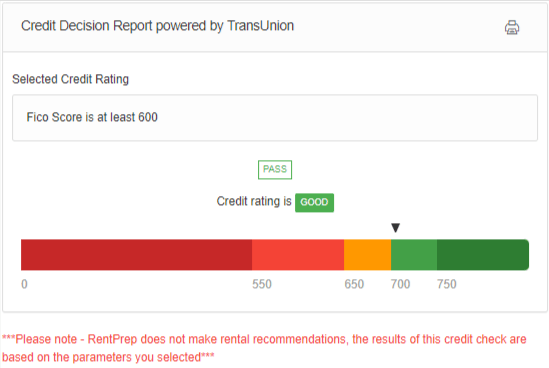

If your tenant applicant has a 650 or higher FICO Score you would see an additional report that would be added to your background check that looks like this:

If they do not meet those criteria you will be told they were denied and provide the reasons they did not pass.

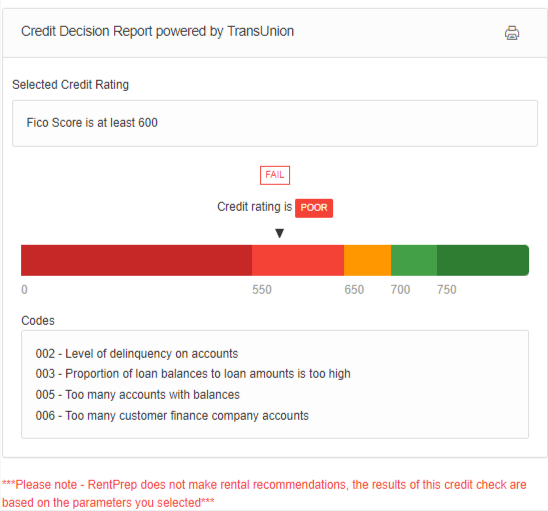

A “FAIL” report would show up in your applicant’s report like this:

The codes provide you insights into the negative factors contributing to their credit score.

If you have further questions on those codes we have an entire knowledgebase section dedicated to them along with screeners standing by to answer your questions.

Will I see the actual credit score with a Tenant Credit Check?

You will not see the actual credit score with our Credit Decision Report, powered by TransUnion, as you would with our TransUnion Full Credit Report, formerly known as SmartMove.

However, you will see a range that gives you an approximation of their score.

You’ll also be provided with a list of codes for why their credit rating did not meet the standard criteria you selected.

We can under no circumstances provide you with the actual credit score but we can help explain the codes if you have questions on your report.

-

Since you will be receiving sensitive credit information, there is a minimum credentialing process the credit bureaus require. This is a one-time step for first-time orders, and includes sending us the following information:

- A copy of your driver’s license

- A copy of the signed rental application

- Proof that you own or manage property. This can be as simple as a mortgage statement, deed, county assessment, homeowners insurance policy, management agreement or anything that identifies you as the owner/manager. You only need to choose one, and it covers you for all properties and future orders.

Tenant Credit Checks can be added to any RentPrep background check for $11.00. Here’s what you’ll get:

- A “Pass” decision if the tenant meets your minimum FICO Score criteria

- A “Fail” decision if the tenant’s FICO score is below your criteria

- A list of reasons why the tenant failed. This typically includes explanations direct from the credit report like “Serious delinquency” or “Amount owed on balances is too high“. This allows you to see the credit behaviors that are causing a low FICO Score.

View Sample Tenant Credit Check Report

You will also receive the FICO Classic 04 codes that were an affecting factor in your applicant’s score

You can view the codes and their explanations below:

| Code | Explanation | Code | Explanation |

|---|---|---|---|

| 000 | No adverse factor | 020 | Length of time since derogatory public record or collection is too short |

| 001 | Amount owed on accounts is too high | 021 | Amount past due on accounts |

| 002 | Level of delinquency on accounts | 022 | Serious delinquency |

| 003 | Proportion of loan balances to loan amounts is too high | 024 | No recent revolving balances |

| 004 | Lack of recent installment loan information | 026 | Number of bank revolving or other revolving accounts |

| 005 | Too many accounts with balances | 027 | Too few accounts currently paid as agreed |

| 006 | Too many consumer finance company accounts | 028 | Number of established accounts |

| 007 | Account payment history is too new to rate | 029 | No recent bankcard balances |

| 008 | Too many inquiries last 12 months | 030 | Time since most recent account opening is too short |

| 009 | Too many accounts recently opened | 031 | Amount owed on delinquent accounts |

| 010 | Proportion of balances to credit limits is too high on bank revolving or other revolving accounts | 036 | Payments due on accounts |

| 011 | Amount owed on revolving account is too high | 038 | Serious delinquency, and public record or collection filed |

| 012 | Length of time revolving accounts have been established | 039 | Serious delinquency |

| 013 | Time since delinquency is too recent or unknown | 040 | Derogatory public record or collection filed |

| 014 | Length of time accounts have been established | 041 | No recent retail balances |

| 015 | Lack of recent bank revolving information | 042 | Length of time since most recent consumer finance company account established |

| 016 | Lack of recent revolving account information | 050 | Lack of recent retail account information |

| 017 | No recent non-mortgage balance information | 056 | Amount owed on retail accounts |

| 018 | Number of accounts with delinquency | 097 | Lack of recent auto loan information |

| 019 | Date of last inquiry too recent |

With RentPrep, running a tenant credit check is a quick and painless process.

All you need to do is sign up, and you can leave the rest to our FCRA Certified Screeners.

You’ll have the completed credit check report in your hands in no time!

Sometimes the credit lingo can be difficult to understand if you’re not familiar with it.

We have an online knowledge base that goes into further detail on each credit code.

You can view that by clicking here.

Do you know who you’re renting to?

Tenant Screening Done Right!