It’s true, a landlord’s responsibilities often require the property owner to wear many different hats.

In this guide, we will assess all the landlord responsibilities you should be aware of before investing in self-managed rental properties.

By understanding your basic obligations it will allow you to avoid unnecessary issues with tenants and the governing bodies.

A table of contents for landlord responsibilities:

- What Are The Responsibilities Of A Landlord?

- List Of Landlord Responsibilities

- Warranty of Habitability

- Landlord’s Legal Responsibilities

- Landlord Responsibilities To Neighbors

- Landlord’s Privacy Responsibility

- Landlord’s Responsibilities With Security Deposits

- Landlord’s Responsibility For Not Renewing a Lease

- Landlord Responsibilities After a Fire

- Landlord’s Responsibility During Inhabitable Circumstances

- Landlord Responsibilities By State: What To Look For

- FAQs On Landlord Responsibilities

What Are The Responsibilities Of A Landlord?

Landlord responsibilities come in many shapes and sizes. Landlords often include an obligation to their tenants to keep a “warranty of habitability.” This is accomplished by making sure the rental is livable, safe, and clean for your tenant. We’ll go over the below in-depth, but here are just a few things that a landlord may be responsible for:

- Finances

- Property Maintenance

- Legal

- Privacy

- Fire Damage

List Of Top Landlord Responsibilities

When you’re a landlord you are a business owner. Your tenants are your clients and your rental is your asset. You’re responsible for taking care of your asset to ensure you’re protecting your investments. Proper upkeep, repairs, payments and accounting will keep a landlord on the straight and narrow. Here are a few other landlord responsibilities to take note of:

Mortgage

It’s important to note that although the tenants have a monthly rent payment, it’s up to the landlord to make payments to the bank to keep up with the mortgage. This is an obvious responsibility of the landlord but worth mentioning.

A mortgage as defined by Consumer Finance is, “an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you’ve borrowed plus interest.”

If you miss one mortgage payment you’re likely to incur late fees laid on out in your mortgage agreement. It’s unlikely a bank will foreclose on your rental after one missed payment.

However, many mortgage lenders will report your payment to the credit bureaus after it has been 60 days past due. This will affect your credit score in a negative manner.

According to Realtor.com, your mortgage is technically in default if you’re more than 90 days late on your mortgage payments—even just one.

You’ll then receive a letter from your lender that you have defaulted on your loan. At this point you’ll have 90 days to submit payment or your property can be foreclosed on by the lender. Long story short, set aside money and pay your mortgage on a regular schedule.

Taxes

A landlord has to keep in mind the taxes for a property. Although renters are coming in and out of the property, legally the home is in the landlord’s name and so are the taxes.

Something to keep in mind: It’s not just the banks that can foreclose on your rental property. The town or city can foreclose on a rental property for unpaid taxes and fees.

For instance, the City of Buffalo files a tax foreclosure list every year. The categories of taxes and fees owed are property taxes, sewer liens, “user fees” (imposed for garbage service), and water bills. Once a property is on the list, and the list is filed and a judgment issued, the owner must pay a foreclosure fee.

Utilities

If utilities are included in a monthly rent payment, they should be in the landlord’s name. If you’ve left it up to the tenants to pay the utilities, it’s important to make sure that they are not in your name, since your tenant is assuming responsibility. Your lease will determine who is responsible for what utilities between the landlord and tenant.

In Buffalo, it is standard practice for landlords to pay for garbage and water.

You wouldn’t want to leave a utility bill in the name of your renter when it could potentially lead to your rental being foreclosed on by the city.

Setup Landlord Utility Accounts

Most utility companies offer a landlord connection service. This has a few advantages, you’re able to easily tell if the tenant has turned on utilities for the rental and taken them out of your name.

During tenant turnovers, you can immediately get into the rental with power and heat as opposed to waiting for a service hookup.

Insurance

Most lenders will require proof of insurance before providing you with a loan for a rental property.

In some cases, you may have an escrow account set up with your lender which pays your insurance policy.

It’s a good idea to require renter’s insurance at your rental too.

A renter’s insurance policy can cost your renter $5 – $10 a month and will cover their possessions that are not covered by the landlord’s insurance policy..

Other Notable Insurances include water, fire, and flood coverage.

Consider an Umbrella Policy:

There are two main ways to further protect your investment. You can do this with an umbrella policy or through setting up an L.L.C.

An umbrella policy will provide an additional layer of liability insurance to your property.

If your tenant has a serious accident that exceeds the coverage of your insurance an umbrella policy can come in handy.

Most policies typically cover between one and five million dollars in damages.

Warrant Of Habitability

We covered earlier that tenants have the right to a warranty of habitability. This means the landlord needs to keep up on repairs and safety codes of the rental property. Things such as peeling paint, clogged gutters, clogged drains, and faulty devices should be fixed. It’s a good idea to keep up on repairs to protect your rental property.

A good example of this is a malfunctioning gutter that is allowing water to pool by the side of the house. In many cases, this can lead to a wet basement which in turn creates moisture. Moisture can then create hazardous mold in the rental property. Keeping up on repairs can avoid costly issues down the road.

As mentioned earlier, a warranty of habitability is an inherent right afforded to tenants regardless of the lease. It is the right of every tenant to have a clean and safe rental. This means the tenant should have functioning hot water and heat in the rental. A broken staircase or insect-infested bedroom are also violations of the warranty of habitability. This inherent right covers just the quality and livability of the rental. It’s a blanket statement.

Safety Codes Landlords Must Follow

Every rental will vary in what safety codes are required. Different states and cities may have different regulations. We’ve included a few in-depth checklist items on how to maintain a rental property below.

Lead Paint

If your rental was built before 1978 you’re required to provide a lead paint disclosure form. Your new tenant should also receive a lead paint pamphlet explaining the risks of lead paint in buildings built before 1978.

Mold Remediation

It is a violation if mold is found in an apartment, and your landlord is required by law to clean the mold and to also fix the condition that causes water to build up.

Occupancy Standards

Every rental will differ on occupancy standards. For example, the occupancy standard for New York State is defined by maintenance code 404.

70 square feet for one occupant in a bedroom and 50 square feet for each additional occupancy for that room.

Living rooms and dining rooms can count towards rooms of occupancy.

You need to be careful not to discriminate against familial status if you have a large family applying for a smaller rental. Understand your local occupancy standards and you’ll know what the maximum tenancy is for your rental.

Smoke and Carbon Monoxide Detectors

Laws will dictate how many smoke detectors and carbon monoxide detectors are required for each room and floor of your rental. It may vary depending on if appliances are in that room or what your state laws dictate. Research the laws specific to your rental’s location.

Keep Common Areas Safe

It is the landlord’s responsibility to keep common areas such as laundry, hallways, and garages free and clear of any hazards.

This would include replacing worn-out light bulbs and providing proper handrails in stairwells.

Window Guards

Depending on the state that you live in, sometimes a landlord must install window guards when asked to do so, in writing, by a tenant who has a child 10 years of age or younger either living in the apartment or regularly spending a lot of time there.

Snow Removal & Other Weather-Related Laws

Here in the city of Buffalo, NY we receive a good amount of snowfall. The landlord and occupant are equally required to make sure the sidewalk is free and clear of ice and snow. In the case of an injury, both would share equal responsibility for any damages. It’s important to read all local and state laws.

No one wants to feel like they’re living in a property that’s not being well cared for. In order to provide a pleasant living environment, landlords need to make sure that the property is being well-kept. Every town or city will have different laws on the standards of your property. Lawn care, outdoor furniture, and snow removal are all aspects that can be monitored by your town.

Landlord Legal Responsibilities

Every landlord should be familiar with the Fair Housing Act (FHA) and the Fair Credit Reporting Act (FCRA). These acts seek to regulate the tenant selection process to ensure accuracy and fairness. In the sections below we will cover these in further detail.

The FHA (Fair Housing Act)

Tenant screening is a process for landlords to find a suitable tenant for their rental.

This can be problematic when landlords use discriminatory practices to screen tenants.

On April 11, 1968, President Lyndon Johnson signed the Civil Rights Act of 1968.

Title VIII of the Act is also known as the Fair Housing Act (of 1968).

The Act prohibited discrimination concerning the sale, rental, and financing of housing based on race, religion, national origin, sex, (and as amended) handicap, and family status. This is all according to HUD.gov.

The U.S. Government included landlords in this Act because of their ability to shape the diversity of a neighborhood.

It’s imperative that landlords understand not to discriminate in their decision-making of who to choose as a renter.

This is commonly seen in advertising listings where a landlord shows preference towards a certain type of renter.

- “Single renters preferred”

- “Looking for female renters”

It is a landlord’s responsibility to make sure their screening practices are free of discrimination and abide by the FHA.

If found guilty of violating the FHA, a first-time offense can come with fines up to $19,787.

Keep in Compliance with FCRA (Fair Credit Reporting Act)

At first glance, The Fair Credit Reporting Act (FCRA) may not seem directly related to landlords.

The FRCA was enacted to promote the accuracy, fairness, and privacy of consumer information contained in the files of consumer reporting agencies.

In addition, the FCRA regulates the collection, dissemination, and use of consumer information, including consumer credit information.

However, when you collect sensitive information on your tenant applicants you’re responsible for properly handling that data.

This means keeping rental applications in a secure environment.

Make sure you have written consent (usually included on most rental applications) to run a background check on a tenant applicant.

An investigative report is not only limited to running a background check. If you call the tenant’s employer or previous landlord you’ll want signed consent to do so.

Never share details of the report with anyone else.

Issue Adverse Action to Denied Applicants

You are also required to issue adverse action to a denied applicant.

This is a generic form that lets the applicant know they were denied and to reach out to the consumer reporting agency for a free copy of their background report.

Landlord Responsibilities To Neighbors

A landlord can be held liable for a tenant that interferes with a neighbor’s comfortable enjoyment. This can be due to noise issues, drug dealing and criminal activity.

In some cities, the landlord can be held accountable and fined for infractions.

Understand Quiet Hours

It might be a good idea to look up the quiet hours of the town or city your rental is located.

You’ll want to address this in your lease in case you do have issues, you’ll have means to resolve the issue with your tenant.

Establish Relationship

It’s also good to know the neighbors. Some landlords will go as far as to offer up their contact information.

This way a neighbor can warn you of any issues and also come to you before filing a complaint to the city.

Landlord’s Privacy Responsibility

Your tenant is entitled to privacy in their home.

As such, many states dictate the laws around a landlord’s right to enter.

A Landlord’s Right To Enter

Landlords can only enter rented premises in the following scenarios:

- To make needed repairs or assess the need for repairs (applicable to some states)

- In cases of emergency

- To show the property to prospective new renters or owners

In most states, the landlord must notify the tenant before entering the property.

Here in New York State, there is no statute but it is recommended you notified the tenant 24 hours before you plan to enter the rental.

In some states, it is clearly laid out as a 24 or 48-hour notice that is required.

Landlord’s Responsibilities With Security Deposits

Imagine you’re a landlord in Kentucky and your tenant has destroyed your rental before leaving.

You take the tenant to court for damages beyond the security deposit only to find you didn’t handle things properly.

In Kentucky, a landlord is required to keep security deposits in a separate account that does not co-mingle with any other funds. They also must notify the tenant where these funds are being kept.

If the landlord fails to do so they will forfeit any security deposit funds.

There are a total of 23 States that have specific rules on how to handle security deposit funds.

Make sure you know what your State’s policy is on security deposits. If you don’t follow these rules you may have to forfeit the funds regardless of tenant damages.

Upfront Fees

Landlords tend to hedge their liabilities by charging fees upfront to tenants such as:

- First month’s rent

- Last month’s rent

- Security deposit

- Application fees

These fees are regulated by each state.

For instance, in Massachusetts, it is illegal to charge any fees upfront for an application fee.

Security deposit limits are set by the State as well. Typically the maximum deposit is one to two times the rent.

Landlord’s Responsibility For Not Renewing a Lease

Again, this will vary by State as some have a policy on this and others do not.

Typically it is a good practice to notify a tenant 60 days before the end of the lease if you plan to not renew.

This will give your tenant ample time to find a new rental while also keeping you within the laws issued by some States.

Pet Deposits and Emotional Support Animals

This is a rising issue amongst landlords and tenants.

It’s important as a landlord to distinguish the difference between a pet and a support animal.

An emotional support animal could be a hamster, dog, cat, or any other animal. This animal serves to provide emotional support for its owners.

If you have a “No Pet Policy” with your rental this does not apply to ESAs and Service Animals.

A service animal is typically a dog that has been properly trained. An ESA typically hasn’t been professionally trained.

Some renters have found it easy to get a letter from a health professional online to give their pet an ESA designation.

When the animal has this designation it’s illegal to charge a pet deposit and you must make accommodations for this animal.

If you deny someone based on a support animal you are opening yourself up to liability as this discriminating towards a disability.

Landlord Responsibilities After a Fire

It’s one of the worst things that can happen to property you own—a fire destroys some or all of the structure. Going through the aftermath of a fire can be devastating, but landlords need to prepare for any event to happen. Being well informed and educated on what to do after a fire at a rental property can ease the burdens that you will face as you try to get your rental property restored and back on the market.

Let’s review what landlords need to do immediately after the fire, the day after the fire, and the days following the fire.

Immediately After the Fire

- Ask a fire officer for a contact number and name for future communications.

- Contact your insurance agent immediately to report the fire and to start the process of filing a claim.

- Get a list of recommended fire damage restoration companies from your insurance company and start calling them to set up an appointment for the next day or two.

- Communicate with your tenant about their safety and well-being, and make note of any sort of details or confessions from the tenant about how the fire got started or what they noticed in the minutes before the fire.

- Make sure your tenants have contacted their own insurance company to line up temporary housing. If they don’t have renter’s insurance, the American Red Cross provides for emergency needs like essential items and temporary housing.

- Ask the fire officer when you and the tenant can walk through the property with them to assess the damage and for the tenant to collect any personal belongings. Never enter the property until you get an all-clear from the fire department.

Days After the Fire

- Take pictures of all damage to every structure.

- Prepare a written inventory of the destroyed or damaged property that should include anything structural, like the home itself or any structures on the property like a pool house or shed.

- Prepare a detailed list, with models and types, of any appliances that were damaged, like a refrigerator or dishwasher.

- Add structural details to the list that covers each room, like cabinets and countertops.

- Collect photos, video, and any other information related to the structure before the fire.

- Get a copy of the fire report from the fire department, which details the probable cause of the fire.

- Never remove debris or start to fix up the damage to the property before meeting with the fire damage restoration company.

- Secure the property as is reasonable, such as locking doors and windows, or covering openings with plastic sheeting.

Common Questions After A Fire At A Rental Property

Once the initial shock of the fire has passed, many tenants and landlords enter into uncharted territory as to who is responsible for paying the repair and restoration bills from fire damages.

Here are some of the more common questions:

- If the fire was the tenant’s fault, do they have to pay for fixing all of it?

- Where do landlords find a reputable fire damage restoration company?

- Who pays the landlord’s insurance deductible?

- What about if the fire was due to landlord negligence?

- Does the landlord have to pay the tenant to replace the cost of lost possessions?

- Can landlords do fire damages repair themselves?

- Do landlords have to pay for tenants to live elsewhere?

- What about the lease agreement now?

All these questions and more will definitely factor into the way that landlords and tenants move forward after such a devastating event.

Rental Property Fire Insurance

Landlords are ultimately responsible for the cost of fixing fire damages to the property itself as it relates to the structure and home systems like electrical and plumbing.

However, the responsibility for repairs and restoration doesn’t always mean landlords are necessarily personally financially responsible.

The landlord’s homeowner’s policy should cover most or all of the repairs.

The landlord’s insurance is not responsible for, nor will they, pay to repair or replace a tenant’s lost property.

The tenant’s own renter’s insurance is in place to cover the loss of possessions like furniture, clothes and belongings.

If the tenant doesn’t have renter’s insurance, they must, unfortunately, suffer the consequences of partial or total loss.

If the tenant can prove in court that the landlord was somehow responsible through negligence, they may be able to recoup the cost of lost possessions and additional expenses in arranging for another place to live.

If the fire is the fault of the tenant or the tenant’s guests, then they must be responsible for the cost of repairing the damages.

However, even if the fire is clearly the fault of the tenant, the landlord still needs to make arrangements via their homeowner’s policy.

The landlord’s insurance company will generally seek out the tenant’s insurance company for compensation if there is a liability portion of the policy.

The insurance company can work with the other company to get compensated up to the liability limit for fire damages.

Another scenario is that the insurance company seeks out the tenant directly for compensation if they don’t carry the renter’s insurance.

Often, wise landlords have included language in the lease agreement that in the event of a fire caused by the tenant, the tenant is responsible for at least paying the deductible for the landlord’s insurance.

From there it will go on a case-by-case basis for recouping the cost of fire damages from there.

Listen to our podcast episode 123 where we discuss how two renters lost their lives due to a fire and the importance of landlords following through with property maintenance.

Making A Rental Property Habitable After Fire

Landlords must provide a rental property that is deemed to be in a habitable condition according to the codes and laws of the state and municipality where the property is located.

The fire restoration experts can provide documentation for you when the property is ready to be occupied again.

It’s important for you to protect your investment and get the house fire restoration process started as soon as possible to take care of fire damages.

Smoke, water and fire damage can cause a structure to weaken over a short time, and even things like mold and mildew can start growing within a day or so after a fire.

You should never attempt to restore a fire-damaged rental property yourself because it requires a certain level of expertise and equipment to ensure that everything is put back into a safe state and meets the minimum safety codes.

It also ensures that there are no hidden issues that may cause problems down the road. A professional fire restoration crew is the only way to go.

In summary, it’s a good idea to review all the things landlords need to do in the aftermath of a fire well before anything actually happens.

In the moments after a fire in the rental property, you can go from panic and stress to pushing forward with a professional and businesslike manner during all the crazy ups and downs that are yet to come.

Landlord’s Responsibility During Inhabitable Circumstances

Landlords are responsible for ensuring that a rental property is habitable. A habitable unit is structurally sound and has adequate water, heating and electricity.

Sometimes, circumstances arise that make the rental unit uninhabitable for a time. Usually, this is due to serious repairs, natural disasters or other significant problems. During these times, tenants often stay at a hotel until the work is done.

When this happens, what is a landlord’s responsibility for hotel bills?

When Would Tenants Acquire Hotel Bills?

In the event of a fire, leaky pipe, or other unplanned emergencies that make a place uninhabitable, tenants have to move out for a while. Most stay in a hotel until the damaged unit is repaired.

Some tenants want their landlord to reimburse them for the cost of the hotel. They often mistakenly assume that the landlord’s insurance policy will cover their relocation costs. Or they assume that because the unit is not habitable they automatically get put up into a hotel of their choice and the landlord foots the bill. These assumptions often lead to conflict.

The truth is that landlord’s homeowner insurance will not cover costs associated with tenant relocation. Nor will it cover a tenant’s damaged belongings. However, most renter’s insurance policies will cover both for the tenant. That’s why many landlords insist that their tenants carry an active renter’s insurance policy.

In most states, tenants can break a lease agreement without penalty if the rental property becomes uninhabitable due to no fault of the tenant. If the tenant is at fault, other laws come into play.

Unfortunately, this situation is not often outlined in a lease agreement. Landlords and tenants often don’t discuss hotel bills and relocation until something big happens.

When is it a Landlord’s Responsibility for Hotel Bills?

Landlords are usually not bound to cover the hotel bill for a displaced tenant when the events are out of their control.

They can reinforce this in several ways. The most common way is to include a clause in the lease agreement.

The clause should state what happens in the event the unit is uninhabitable due to unplanned circumstances.

If the unit is uninhabitable for just a few days, landlords should prorate the rent for the number of days it could not be occupied.

The tenants would be responsible for their own lodgings in the meantime.

If the problem arose out of something the landlord did or didn’t do, then the tenants could petition for hotel reimbursement directly or through small claims court.

When the unit is uninhabitable for an indeterminate amount of time, many states require that the landlord release the tenants from the lease agreement and prorate any rent already paid.

Plus, the tenants must receive their deposit back. There is generally no landlord’s responsibility for hotel bills.

Sometimes landlords schedule things like fumigation or a fast remodel that require the tenants to vacate for a short period of time.

In these instances, landlords often cover reasonable hotel costs for good tenants for a few days.

They may feel it is worth it to them to keep the tenants and accommodate them. In other cases, they prorate the rent only for days that the unit was inhabitable. This is completely up to the landlord, however.

For more information on landlords paying for hotels, check out this video:

How To Include A Lease Clause for Hotel Bills

Here at RentPrep, we feel that landlords across the country should include a clause in the lease agreement that requires tenants to carry renter’s insurance. It’s the easiest way to deal with relocation in case of emergencies in addition to liability and reimbursement for any damaged or destroyed property.

Landlords should also include a clause about what happens if the unit is not habitable.

It’s a good idea to put reasonable time limits on repairs, fumigation and remodels.

For example, the lease could say that if the property becomes uninhabitable for more than 5 days, then both parties bear no more commitment to the agreement without penalty.

It’s important for landlords to be fair about prorating rent.

After all, if a tenant can’t live in a unit they have paid rent on, they should be compensated.

However, that compensation should usually not extend to paying for hotels, especially when an affordable renter’s insurance policy will do so.

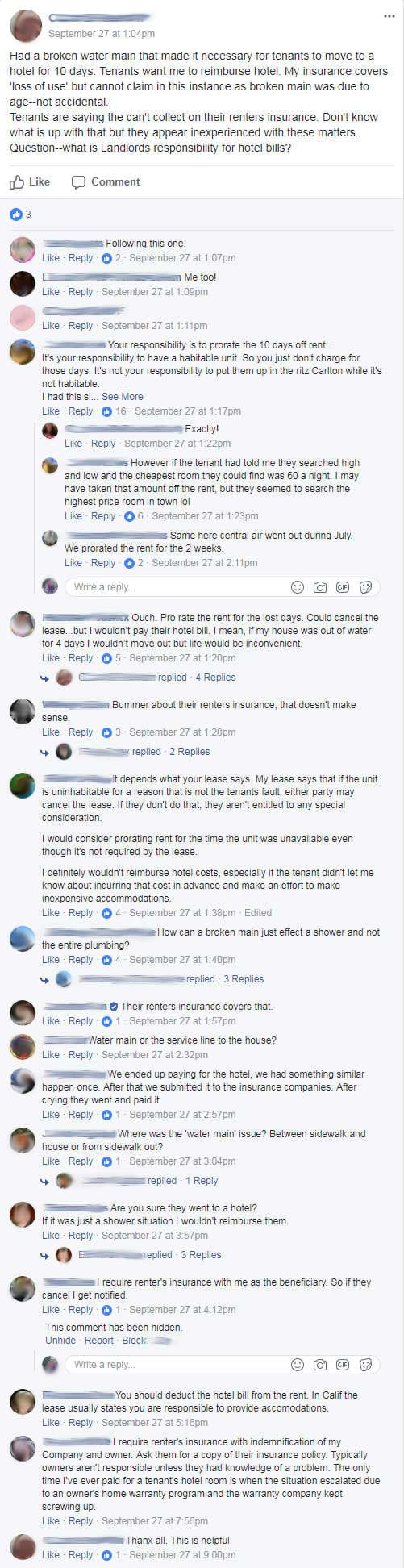

What Are Other Landlords Saying About the Responsibility for Hotel Bills?

Every landlord needs to comply with local and state laws regarding uninhabitable properties. There’s always peace of mind in consulting with a landlord/tenant attorney as well.

Here’s a screenshot of landlords discussing this question in our private Facebook group for Landlords.

Landlord Responsibilities By State: What To Look For

Every state has laws unique to landlords and renters. In the section below we will list out what you should be on the lookout for.

Security Deposit Maximum: Ranges from 1 – 2.5 months rent. In California, you can charge the additional half month’s rent if it is a furnished rental

Security Deposit Interest: Some States require you to keep security deposit funds in an interest-bearing account and give the interest to the renter

Separate Security Deposit Account: Does your State determine if the funds can mingle with personal assets or not?

Pet Deposits and Additional Fees: As mentioned earlier some States (MA) do not allow any fees which would include pet deposits

Deadline for Returning Security Deposit: In some instances, there is no statute but on the whole, this varies from 14 – 45 days

Rent Increase Notice: Check with your State’s laws before increasing rent

Late Fees: Some States allow a grace period for rent where others do not address this

Returned Check Fees: If your tenant bounces a check, make sure you read up on your State’s laws before charging them a feee

Move-Out Inspection Notification: Understand the timelines of when you need to perform a move-out inspection

Eviction Notice for Nonpayment: This can vary from 3 to 30 days depending on the State

Eviction Notice for Lease Violation: If your tenant violates the lease you can serve a remedy or quit notice. Typically the timeframe is mandated by your State.

Required Notice before Entry: This typically ranges from no notice required to 72 hours

Emergency Entry Allowed without Notice: Understand your rights as a landlord in an emergency situation

Small Claims Court Limits: If a tenant damages your rental there is a cap on small claims court.

Resources

https://www.hud.gov/

https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-credit-reporting-act

https://www.justice.gov/crt/fair-housing-act-1

FAQs On Landlord Responsibilities

Whether you are a new landlord or a seasoned landlord, there is always a question to be asked about who is responsible for what on your rental property. Here are some of the most frequently asked questions regarding landlord responsibilities.

Are landlords responsible for pest control?

The landlord is responsible for providing a clean and pest-free property to the renter. If the renter is responsible for a pest infestation they can be held liable instead of the landlord. The video below goes into this topic with far more detail. You can also check out our in-depth guide on pest control here.

Is it the landlord’s responsibility to clean the gutters?

This should be addressed in the lease. If there is no section addressing the cleaning of gutters it will vary from State to State. In most cases, a single-family home is more likely to be the responsibility of the renter where multifamily would fall on the landlord’s responsibility.

Do Commercial Landlords have additional responsibilities?

Commercial landlords will have an added set of responsibilities compared to private residential landlords. Make sure the property abides by commercial building codes and adheres to commercial insurance laws. It’s also a good idea to increase your liability insurance as there are more moving parts with a commercial rental property.

What maintenance responsibilities does a landlord have?

Because many landlord-tenant disputes arise from repair, maintenance, or habitability issues, it pays to know what your responsibilities are before tenants start to call.

Some states attempt to make landlords’ access to the rules easier by collecting them all in one place. For instance, California’s Department of Consumer Affairs offers an outline of landlord and tenant maintenance responsibilities. The website for North Carolina includes a downloadable pdf booklet that explains both landlord’s and tenant’s maintenance and repair duties.

Your city or state housing office is a good place to start seeking information on specific maintenance and repair duties for rental properties in that area. Local landlords’ or property managers’ associations can also provide information, as well as useful tips.

How Responsible Of A Landlord Are You?

There is a lot of responsibility in being a landlord but it can be a fruitful pursuit if you know what you’re doing.

The first thing to know is that a good tenant makes for a great landlord and it all starts with quality tenant screening.

Stay up on your properties and cover yourself with the proper insurances. You’ll have a happy renter and less issues in the long run.