Every once in awhile I wonder if I should have water line insurance for a rental property.

About 3 years ago I was living in my owner-occupied rental and and a few blocks away a friend had the water line burst at his rental.

I asked Rich if he would share his story and he was generous enough to provide the story below:

Is water line insurance worth it?

When I first purchased the house it had all new copper plumbing so the thought of any water issue was somewhat minimal. Who actually thinks something is going to go wrong with the waterline outside of their home right?

As always, you are offered all sorts of coverage options for your newly purchased home which I declined confidently based on my perception of the quality of the house. The mechanics were sound, no issues in the basement, roof was newer and the list goes on.

As it turns out, there was a leak in the waterline outside of the house, which was not discovered for a year or so after the purchase. And it wasn’t me who discovered but the City of Buffalo. The water pressure and cost was not impacted because it all happened before the meter and feed into the home. Nothing is better than showing up from a trip out of town to an open hole in your driveway and no water running to your house. The City of Buffalo Water had originally dug up the pipe because they had the impression it was an issue for the city to fix. After exposing the issue, they discovered that it in fact the homeowner’s responsibility for this particular portion of the line so they kindly left their boards but told me to take care of it. After calling several plumbers and getting quotes ranging from $2,500 – $6,000 it definitely made an impact on my impression of insurance. Hindsight is 20/20 for sure, but it would have more than welcomed at this point. The benefits of having a pre-approved network of tradesmen, a guide along the way and the cost covered is substantially better than trying to wrangle in a contractor for a small job, last minute and for a premium. The line was fixed over the weekend and the hole was filled all for a little north of $2,500 out-of-pocket. The portion of the driveway impacted remained as stone for quite some time until I got lucky and capitalized on a personal connection to a concrete contractor.

As a landlord, there is a lot of responsibility that goes into keeping a house in great shape. Insurance, while a small added cost, could definitely help reduce the stress levels and allow you to focus on future investments of time and money back into the home.

Water line insurance in my city

In our location in Buffalo, NY there is the main city water line which is owned by the city. Then, there is the water line that connects to the home, which is the responsibility of the property owner.

I’ve known for years that this pipe can burst causing $1,000’s of dollars in damage but it’s just not an immediate concern. So I’ve done nothing about it.

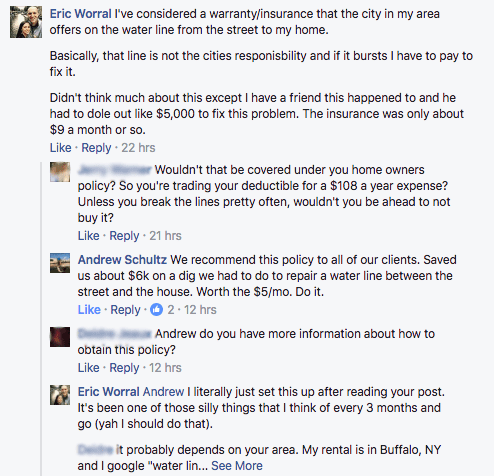

Until last night when a discussion started in our RentPrep For Landlords Facebook Group.

Here’s a snippet of that conversation:

First thing to note is my memory is pretty inaccurate. Rich got a screaming deal at $2,500 and the insurance is actually cheaper than $9.

Andrew, who responded, is a recent guest we had on our podcast.

I trust his opinion on matters like these, so I took the plunge and signed up for water line insurance for my rental.

Google “Water Line Insurance (city name)”

Do a Google search for water line insurance and your city name.

When I did this for my location it was “Waterline insurance Buffalo NY” which got me this local listing.

My local site then pushed me to this website: https://www.dominionenergysolutions.com/

This allows you to put in your zip code and see available insurances.

I selected the “Water Line Replacement Program” at $4.95 a month.

To me, $59.40 a year to cover a potential $6,000 cost seems like a no-brainer.

I look at this like a luxury purchase. I can afford the $60 a year and it removes the anxiety I get every few months when I think about what would happen if that water line bursts.

I understand that odds are that my water line doesn’t burst. However, the peace of mind is worth it for me.

Is Water Line Replacement Insurance Deductible?

This article covers the difference between a repair vs. improvement of a water line and how that differs with your taxes.

This irs.gov article is a good read and says the following about necessary expenses.

You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental property. Ordinary expenses are those that are common and generally accepted in the business. Necessary expenses are those that are deemed appropriate, such as interest, taxes, advertising, maintenance, utilities and insurance.

I would assume that the $59.40 spent yearly on water line replacement insurance is tax deductible on your rental.

Is Water Line Replacement Insurance Worth It?

Like many optional insurances, you never really know until many years from now.

If I have a break 2 years from now it’s probably worth it.

However, if I have this rental for 10 more years the total cost is $594.00. For me, I’ll pay the minor fee for peace of mind.