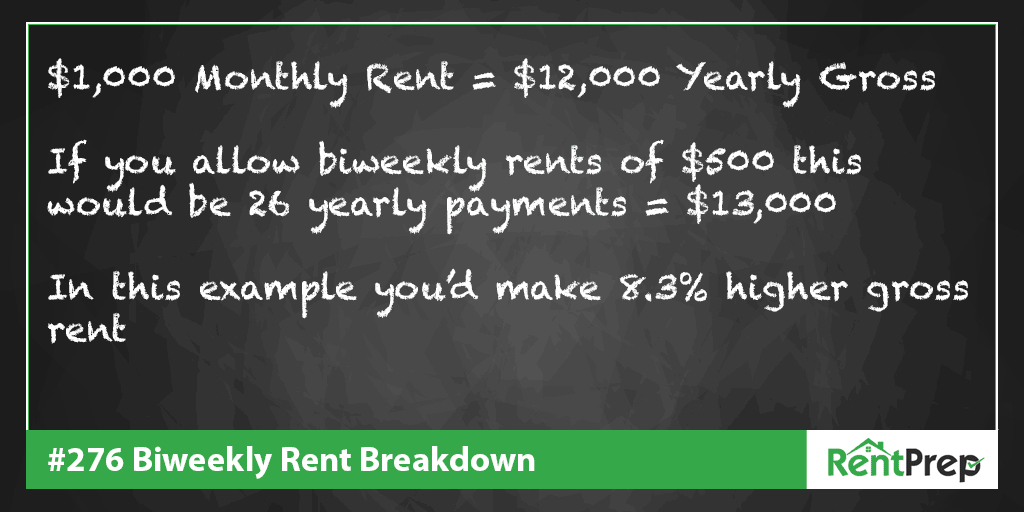

Can accepting rent payments biweekly really increase rents 8.3%?

Click here to listen on iTunes.

Click the Big Green Play Button to Listen to the Podcast

We discuss the merits of bikweely rents, offering alternative security deposit options, and how much Taylor Swift was paying in rent in NYC.

Subscribe: Apple Podcasts | Android | Stitcher

Join our Facebook Group of over 10,000 landlords and property managers

Can you do us a solid?

Our podcast has grown over the years because of listeners like yourself. One way you can help us grow further is by leaving us a review of our podcast. It will only take a minute and you can find detailed instructions by clicking here.

Resources Mentioned in this Episode

Show Transcription:

Speaker 1: (00:00)

Hey everybody, welcome back to another episode of RentPrep for landlords is episode number 276. And we’re going to be talking about why you should consider making your leases more flexible for generation z out there. And also a, a fun story about the landlord who is renting to Taylor swift but had no idea that he was. All right guys? Well, let’s get back to that right after this. Come to the rent prep for landlords podcast and now your host, Steven White and Eric Worral. So our first story comes from inside edition.com and this was from September 6th. The a headline is meet the man who is Taylor Swift’s and landlord at 23 Cornelius Street. So, uh, this a story here, if you’re not familiar with Taylor Swift country music star, uh, he said that, uh, David l was, the landlord said he initially didn’t even know who she was.

Speaker 1: (00:55)

He got this call saying somebody by the name of Taylor swift wanted to rent the place. And although I had her songs, my running list, I didn’t entirely know who the artist was. Swift rented Al Dia’s, $11 million in New York townhouse in 2016 for nearly get this $40,000 a month for an apartment she bought nearby was being renovated. I can’t imagine spending a half a million dollars in rent per year, but I also probably can’t imagine making Taylor swift kind of money. So it’s a once word got out, she was living there, the Paparazzi were everywhere. Luckily LDS says the home had all the security amenities that swift was looking for, including cameras and guards. 24, seven. The home had four bedrooms and even an indoor lap pool making it the perfect Bachelorette pad. But swift wasn’t single for long. Taking up with British actor, Joel,

Speaker 2: (01:43)

all women. [inaudible].

Speaker 1: (01:49)

So this actually the story is a nice segue into our main article that we’re going to be focusing on today from Forbes a where it’s talking about having amenities. So in this particular case, Taylor Swift wanted that 24 seven guards and cameras, uh, which you know, is probably pretty easy to pony up for when somebody’s paying you $40,000 a month in rent. Um, but in our other article, uh, which is coming from Forbes, this was a titled this landlord coach says flexible lease terms can reduce turnover and increase profit on rentals. So this was published on September four, 2019. Uh, there is some, uh, good mentions in here on why amenities and being flexible on the lease is what generation z renters are interested in. It said that these renters tend to be frugal and kind of cautious when it comes to renting. They’re also digital natives with a completely different set of expectations when it comes to modes of payment and communication with their landlord.

Speaker 1: (02:44)

So there was some interesting highlights in this article, uh, from the Forbes real estate council member, Jeffrey Taylor. And it was saying that turnover is one of the biggest killers of cashflow for the rental property owners and landlords can encourage runners to voluntarily rent for longer by getting them more actively engaged in the decisions surrounding the lease terms. Those can create more of a win-win environment. So I agree with this. Uh, actually from a marketing perspective, a lot of times if you can get somebody involved into the decision, devote it feeling like they made the decision themselves, uh, it gets more buy in. You’ve probably heard this in sales trainings before to a where you get certain sales agents that’ll come to your house. Maybe it’s a roofing contractor and he goes, oh, are you Eric whirl? And you say yes. And, uh, is this your roof?

Speaker 1: (03:28)

Yes. And um, would you agree that, uh, you know, you’d like to get a new roof on probably by the end of the year. Yes. And you’re like, why is he asking me all these questions? Well, they call these micro conversions just by getting somebody on, uh, saying yes repeatedly. It kind of makes it like, okay, yeah, this is a, it makes it easier to say yes when they’re actually asking for the sale. So what he’s kind of talking about here is that if you can get the renter more involved in the decisions on the lease, it makes it feel like they are more involved with the actual process and more likely to stay on longer. So he says what he does is he offers individual residents options and the lease terms will work best for them. He begins by asking new residents that they would prefer a one year lease or a month to month agreement with a slightly higher 30 to $50 rate, but greater flexibility.

Speaker 1: (04:19)

So you’re giving them choice, right? They’re out of the gates. He also offers security deposit options, which this one I haven’t heard really too much of. He says that residents can pay the standard one month’s rent plus security deposit so that you know, is your standard. Uh, and then they can do that up front or they can pay a reduced security deposit upfront and a small monthly rent increase, usually half of the standard security deposit and a 5% monthly rent increase. So it’s Kinda tough to, uh, kind of do all that, you know, as I’m reading that out. But let’s suppose that your typical, uh, your rent is $1,000. So normally you’d be asking for $2,000 up front as a thousand would be your first month’s rent and then a thousand for your security deposit. So what he’s saying is they can reduce it, the security deposit up front, and usually it’s half.

Speaker 1: (05:09)

So instead we’re going to do, we’re going to do $500 upfront for the security deposit, and then you know, 1000 for first month’s rent. So as the landlord, you’d be out $500, but if you’re increasing the monthly rent by 5%, that would be $50 a month that you’re increasing the rent because of the reduced security deposit and over 12 months in your priority done the math here, that would be $600. So at the end of year one, where you’d be looking at is a, an increased, uh, earnings of $100 if they were to stay on for the entire year, uh, going through that method. But the interesting thing is, is you do have a little bit more liability, right? Because if they do end up damaging the rental, you have a $500 security deposit instead of a thousand. But if you’re also talking about maybe this person stays on for two years, then that second year, if you do your standard 3%, you know, three to 5% increase in rents, uh, you would be getting, you know, another hundred dollars at second year.

Speaker 1: (06:15)

For me at least. I don’t know if I’d want to give up that extra a security deposit just to make an extra hundred dollars a year. But I can see if you are making them more involved in the lease decisions and you get an extra year of tenancy out of it. So maybe they go from two to three years and over that three years you got an extra $350 and they’re great tenants. Sure it’s gonna work out. But for me at least, I, I’d feel like I’d rather have the extra security deposit. Uh, reading more on here though, he talks about good residency options and how they want to choose to pay their rent, either traditional monthly payment or payment every two weeks. So maybe you’ve heard about this biweekly rule, so it says it will correspond with their paychecks. The latter option comes at a slightly higher rate.

Speaker 1: (07:01)

However, and Taylor says that some residents prefer this option because it helps them budget their payments better. Additionally, he said that today’s time and should be given the option of paying traditionally via check or with automatic payments drafted from your checking or savings account. So if you haven’t heard about Diaz biweekly rent payments, um, the way it would work is if somebody is paying monthly rent at $1,000, at the end of the year, you’d get 12 payments and it would, uh, total up to $12,000. Now what you can do is you don’t actually, um, it’s not hard to do the math on this one. What you would do is you can offer by weekly payments and just say, hey, instead of paying $1,000 a month, you’re gonna pay $500 a week. So to most people when you hear that, you just think, okay, runs 1000 bucks a month, but it’s not really because it’s really 1000 bucks for every 28 days. When you go with this kind of payment schedule, what there would be is actually 26 payments, uh, happening because you’re biweekly, right? And, uh, 52 weeks, a year divided by two would be your 26 payments and at $500, uh, let me do the math on this. Hey, Siri, what’s 500 times 26 equal

Speaker 3: (08:15)

500 times 26 is 13,000.

Speaker 1: (08:18)

All right. There you go. That gives you an extra thousand dollars a year. So you’d go from 12,000 to 13,000. Okay. And then, hey, Siri, what’s 13,000 divided by 12,000 equal?

Speaker 4: (08:34)

Yeah.

Speaker 3: (08:34)

13,000 divided by 12,000 is about 1.0833.

Speaker 1: (08:39)

So that 1.0833 essentially what that saying is that if you do somebody with a biweekly, uh, rent, I, you at the end of the year, uh, if you were to just kind of go through the scenario I described, it would be an 8.3 increase in, uh, rent payments at the end of the year. So something to consider. Uh, there also is kind of a, a moral sense to this though. Like you want to make sure the person understands what they’re signing up for. Um, and that they realize that there’s going to be extra payments with this. Essentially they would have those two extra payments that um, do you kind of snuck in there because you’re paying on 28 days and there’s typically 30 days per month. But if you’re looking at rent payment options and somebody requests that or you at least offer it as an option, a, you can say, hey, we offer biweekly, um, rent payments and a here’s what the amount would be and you can just cut the rent in half.

Speaker 1: (09:36)

If you do that, you’re looking at 8.3% increase in rents. So, uh, something to consider. And then reading further in this article, it talks about many of these um, washer, dryer, Wifi, lawn service or additional variables that can be added or subtracted from the lease terms. Tillers says that the important part of offering flexible leases is establishing a collaborative landlord tenant relationship up front when meeting with renters to sign a new lease and go over the terms. I would encourage rental property owners consider offering renders the opportunity to provide input and some of the above lease terms. He says that by, uh, utilizing these strategies, you can increase the landlord’s average annual net income by 10 to 20%. They can also increase the average length of time rose and his stay rental properties by any additional year. More. So the a 10 to 20% is pretty believable as far as if you can get 8.3% just by going to a biweekly rent payment.

Speaker 1: (10:26)

Uh, it’s not hard to, you know, make up the additional 2% 20% I think would be tough. Uh, because, uh, I guess if you’re adding a washer and dryer and they’re paying for it, or they’re paying for the Wifi, or I don’t know how he’s getting the extra 12% on there. Um, but yeah, if somebody’s willing to pay it, of course you’re gonna get it. Uh, and if you’re casual in a property and it’s making a few hundred bucks a month, uh, an additional 10 to 20%. If it’s all cashflow, I mean that’s substantial. Like in, in the case of the additional thousand dollars, let’s say, uh, when we were charging 1000 bucks of rent and you’re making 200 bucks a month, at the end of the year, you’re gonna make $2,400. Well if you go from $2,400, and now this is, we’ll back this up, cause I know I just Kinda said that quickly assume that you’re charging $1,000 a month, rent your cash flowing $200 a month. At the end of the year you’d have $2,400 if you were to do the biweekly payments, like we kind of talked before and do the $500 a week and now it’s 1300 you just jumped from $2,400 to $3,400 in additional revenue from that property. Cause that’s all a cashflow. That additional 8.3%. It’s not like you had to like put in a washer dryer and then depreciate that or worry about that breaking. So when you’re talking about a thousand dollars increase, well let’s ask serious and more math here. Hey Siri, what is 3,400 divided by 2,400 equal

Speaker 3: (11:55)

3,400 divided by 2,400 is about 1.4166.

Speaker 1: (12:00)

So what that’s telling us is that would increase your profits by 41% in that particular case, if you’re a cash flowing, a couple of hundred bucks on $1,000 rent. So that’s a huge, huge increase. I know sometimes at the end of the year you might look at and be like, wow, 1000 bucks. That’s pretty good. If you’re talking about your bottom line cash flow though, and you’re talking about a 41% increase to your bottom line cash flow by offering biweekly rent payments, that’s substantial. I mean, 8% 10% is good in the stock market. If you’re talking about increasing your returns by 41% in the cash flow, that’s huge. So definitely something worth considering. Uh, you may wanna, you know, take a look at some of your rentals and, uh, next time you’re going through the leasing process, maybe consider offering it on there as an option. And if somebody wants to take it, just explain, hey, what we do for the biweekly, uh, is it’s set up automatically and it’s half the standard rent amount if you pay monthly. And, um, you know, you can spell it out for them and let them know, but they may prefer that because it helps them budget themselves if they’re paid biweekly and that, that money can just come out automatically. All right, guys, that is it for this week. Ah, hopefully you found this helpful and, uh, yeah, look forward to catching up with you guys next week. All right. Good luck and take care.