Updated August 2021

A comprehensive credit and financial history is a key component of every tenant screening report. But how long is bankruptcy reportable on these consumer reports?

Due to how closely linked bankruptcy, credit, and debt are, they are all considered public records and are included on consumer credit reports. However, not all bankruptcies are the same. For this reason, different types of bankruptcies are included on reports for different periods of time.

Landlords need to understand, when bankruptcies do show up, what the bankruptcy terminology means and also when bankruptcies are removed from reports. Without this information, you could end up making an uninformed decision about a potential tenant, leading to a stressful situation.

Today, learn more about how long bankruptcy information can be reported, what you can do with this information, and other aspects of bankruptcy reporting that are relevant to landlords.

A Table Of Contents On Bankruptcy Reporting Periods

Do you know how long bankruptcies are reportable on the consumer reports used for tenant screening? Get all the info you need on bankruptcy reporting today.

- How Long Is Bankruptcy Reportable On A Consumer Report?

- Why Does Experian Report Bankruptcies For 7–10 Years?

- Should Landlords Rent To Tenants With Bankruptcies?

- FAQs

- Bankruptcy Reporting: Know Your Facts

How Long Is Bankruptcy Reportable On A Consumer Report?

There are various answers to this question, and the answer you need depends on what type of bankruptcy you are looking at.

Each type of bankruptcy is reportable for a different period of time from the date of filing:

- Reportable for 10 years: Chapter 7, 11, and 12 bankruptcies

- Reportable for 7 years: Chapter 13 bankruptcies

The reporting time is different for different types of bankruptcies due to whether or not repayment is required.

According to Experian, “Chapter 13 bankruptcy is deleted seven years from the filing date because it requires at least a partial repayment of the debts you owe. Chapter 7 bankruptcy is deleted 10 years from the filing date because none of the debt is repaid.”

Experian is one of the three major credit bureaus and can be viewed as an authority on the subject. However, this is Experian’s policy for their own consumer credit reports.

Experian is a “furnisher of information” for consumer reports. The laws that decide how long information is reportable on a consumer report give rules to furnishers; however, Experian can choose to give information for a shorter period of time. The law only restricts them from giving the information out for too long.

The true answer is that a consumer reporting agency, or CRA, can legally report bankruptcies for 10 years.

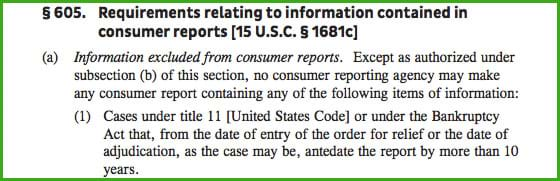

The excerpt above is from page 22 of the FCRA, which is the Fair Credit Reporting Act.

FCRA: The Law That Determines Reporting Rules

When running a background report, the Fair Credit Reporting Act is the federal law that regulates how long a CRA can report information. The FCRA was designed to ensure that true, accurate information is provided about consumers and that consumers are protected from invasion of privacy.

Any individual, organization, or company that provides information to a credit reporting agency must follow the legal obligations laid out by the FCRA. These obligations include:

- Ensuring you provide complete and accurate information

- Investigating any disputes you receive on the information

How Does Bankruptcy Reporting Work Over Time?

Suppose you aren’t closely familiar with credit reports and how bankruptcy filings show up on these reports. In that case, it can be confusing to decipher what it means when a bankruptcy is no longer reported.

Consumer reports typically include the following information from bankruptcy filings:

- The federal bankruptcy court documents

- Information about which debts were discharged or included in the bankruptcy filing

Let’s use an example situation to give you the best understanding of what you can expect to see on a report.

Eric missed a payment on his personal loan on May 2, 2007 due to injury and ended up never making another payment. Eventually, he filed for bankruptcy and it went through.

If we were to look at his credit report after he filed for bankruptcy, it would show that bankruptcy. The personal loan account on which he missed payments will also show up on the credit report, but the balance will be zero. There will be a note on that account stating that the personal loan debt was included in the bankruptcy.

Because Eric filed for bankruptcy on a personal loan, the loan will disappear from the credit report after seven years, while the bankruptcy filing itself will remain for 10 years. This can be a bit confusing to look at, as the credit or tradelines included in the bankruptcy filing may no longer be on the credit report.

If you are examining a prospective tenant’s credit report and finding the information confusing, consider the difference in timelines to better understand what you’re looking at.

Why Does Experian Report Bankruptcies For 7 To 10 Years?

Here’s an excerpt from the FTC that provides a summary of your rights under the FCRA:

What this means is that Experian, which is a publicly traded business and not a government agency, can decide to not report chapter 13 bankruptcies beyond seven years even though they could report them for longer.

However, the FCRA is laid out in a 108-page document, and there are zero mentions of Chapter 13 bankruptcies or Chapter 7 bankruptcies within those 108 pages.

If you read the first sentence of the FCRA document, it states, “As a public service, the staff of the Federal Trade Commission (FTC) has prepared the following complete text of the Fair Credit Reporting Act.”

The FTC is explained by Wikipedia in this manner: “The Federal Trade Commission is an independent agency of the United States government, established in 1914 by the Federal Trade Commission Act.”

The FCRA is the authority on how consumer reporting agencies should be reporting data. The FTC enforces the FCRA and has laid out clearly that 10 years is how long a bankruptcy is reportable. They are the final authority on the matter, and their rules stand.

Why Do Many CRA’s Say 7–10 Years?

Many consumer reporting agencies will plug into Experian’s data to provide background checks. If you call and ask that service how long a bankruptcy is reportable, they will provide what Experian provides to them.

Therefore, Experian becomes an authority as they’re the data furnisher, and they decide to not report some bankruptcies beyond seven years.

The FCRA is the authority and says 10 years, but Experian is the furnisher of information that influences many CRAs.

It’s important you understand the rules and regulations of the FCRA and not the rules laid out by a bureau.

Should Landlords Rent To Tenants With Bankruptcies?

A landlord who sees a bankruptcy on an applicant’s credit report may be tempted to deny their application immediately, and that is within their right. However, the landlord should take a moment to digest the information and determine if that bankruptcy is a reflection of the applicant’s current financial situation.

When To Consider Renting

For example, a tenant who filed for bankruptcy more than five years ago and has not had any other financial issues since may be worth considering. Consider how much debt they discharged, the circumstances of the bankruptcy, and what their current income looks like.

By verifying their income, current references, and rental history, you can determine if that bankruptcy truly increases the risk of renting to that applicant.

When To Avoid Renting

On the flip side, it may not be in your best interest to rent to a tenant who has a bankruptcy within the last two years on their credit report regardless of their current situation. If you want to try to make this situation work, consider requesting a co-signer for the rental agreement.

By having a secondary signee on the agreement, you will ensure that you are able to collect the rent even while renting to a more risky tenant. Sometimes this will pay off and can be a nice way to help someone start to rebuild their future after bankruptcy.

However, do not feel obligated to offer this. Just as the applicant needs to secure their financial state, you need to keep a good hold on your own. Your business security is more important than offering this second chance to an applicant.

Regardless of whether or not you choose to rent to tenants with a history of bankruptcies on their record, you first need to know this information. Choosing the right tenant screening service will make a huge difference in the success of your rental business. For a full selection of screening options, check out what RentPrep has to offer today.

FAQs

Do bankruptcies need to be declared after 10 years?

In most cases, bankruptcies do not need to be declared after they have been cleared from consumer reports records. However, there are some situations where bankruptcies are still expected to be reported. For example, some financial documents will ask signers to confirm if they have ever filed a bankruptcy before.

However, when it comes to rental properties, bankruptcies that happened so long ago that they are no longer on a consumer report are not likely to be a good current representation of a tenant. As a landlord, you should not worry about bankruptcies that happened more than 10 years ago.

If the tenant has good, clean credit now, they have learned from their financial mistakes and made strides in improving their situation. This is actually a positive. If a prospective tenant chooses to be honest and disclose that they had a bankruptcy more than 10 years ago, consider what that means about their current growth and situation when making your decision.

Do bankruptcies show up on background checks?

Whether or not bankruptcies show up on a background check depends on the type of background check that you run. While not included in criminal background checks, bankruptcy filings are part of the public record. This makes them very easy for landlords, employers, and other individuals to discover. It is allowed within FCRA rules to find out about bankruptcies.

There are no set rules about how far back a background check goes or what information is included. This is why it is important to know how to run a background check properly and to review what any service you use provides before making a purchase.

Bankruptcies will show up on SmartMove, and RentPrep Background Checks as they are included as part of the packages. These are built to make screening a more straightforward and time-efficient process. From bankruptcies to evictions and judgments, choosing between these packages can get you the information you need to choose the right tenant.

Do dismissed or discharged bankruptcies show up on credit reports?

To understand if these bankruptcies show up on your credit reports, you need to know the difference between dismissed and discharged bankruptcies.

Dismissed bankruptcies are bankruptcies that were filed but no longer considered because the bankruptcy terms have not been met or fraud has been found. If the court or bankruptcy trustee reports this type of dismissal to credit bureaus, it will show up on a credit report.

Dismissed bankruptcies can, in some cases, be removed from a credit report. If the report is disputed and the courts do not respond, the credit bureaus will remove it from the record.

Discharged bankruptcies are bankruptcies that have been successful and are in processing. This means that all of the debtor’s debts are being wiped clean, and creditors can no longer claim those debts or try to collect them. When this occurs, those debts must be listed as included in the bankruptcy. These will show up on a credit report until sufficient time has passed.

What are FCRA violations?

As mentioned, the FCRA, or Fair Credit Reporting Act, outlines guidelines about how consumer data can and cannot be used. Due to the complicated nature of these laws, it is possible to violate them, often unintentionally.

Landlords need to be familiar with the most common types of FCRA violations. Understanding these violations and how to avoid them will protect you from large fines or tough situations in the future.

The most common FCRA violations include:

- Furnishing, reporting, or using data that is not current

- Reporting or providing data that is linked to the wrong name

- Not correcting inaccurate data after a debt dispute is filed

- Not alerting all required parties (i.e., CRAs) of any debt disputes or changes

- Releasing information to unauthorized parties

- Accessing a credit report without a valid reason

- Not giving proper notice to the debtor about the credit information

For landlords, the two biggest violations are requesting a credit report without authorization from the applicant and not alerting the tenant when negative credit information was used as part of your decision-making process.

Many of these violations are more likely to be committed by creditors, collectors, or credit reporting agencies. If the organization you use to run credit reports is guilty of any of these violations, it could lead to problems with your own use of the information gathered down the line.

That’s just another reason it is essential to choose tenant screening companies carefully. The highest-quality companies will ensure that all reports are completely FCRA-compliant.

Can a potential tenant dispute a consumer report?

Suppose something shows up on an applicant’s credit report that causes you to deny their application. In that case, it is your responsibility as a landlord to let them know that information from this report led to your decision. Additionally, you should let the applicant know what reporting agency provided the report and how they can receive a copy of the report themselves.

This allows applicants to dispute a consumer report if they do not believe the information is accurate. For more information on how to dispute a report, direct applicants to the FTC website.

If a tenant tells you they don’t believe the information is accurate, take their claim seriously and contact your screening or reporting agency as soon as possible. Using false information to make your decision about a tenant is not permitted. Though the applicant should also do this, it is important that you do your part to try to correct the information as soon as possible.

Bankruptcy Reporting: Know Your Facts

Landlords must be able to make sense of all of the information they get from background checks and credit reports. The point of gathering this information is to be able to make an informed decision about whether or not a prospective tenant would be a good fit for your property. If you don’t know what information is and is not included, you cannot do that.

This is why it is important to understand when bankruptcy reports are included, what that means for a potential applicant, and how you can use that information to your advantage.

Do you know what you would do if you had an applicant with bankruptcy on their report? How do you feel about bankruptcies that happened so long ago that they have been removed from reports?

Landlords need to work through these questions so they are prepared to handle any financial history they encounter. Hopefully, the information provided in today’s guide will give you the baseline information you need to do just that.