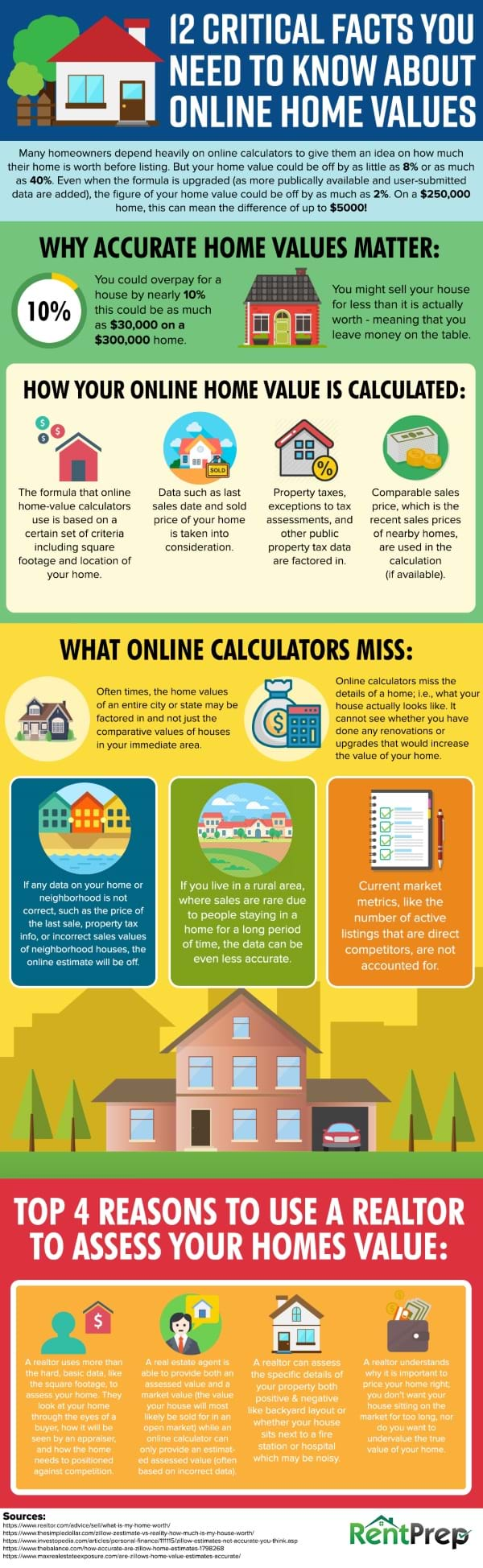

Many homeowners depend heavily on online calculators to give them an idea on how much their home is worth before listing. But your home value could be off by as little as 8% or as much as 40%. Even when the formula is upgraded (as more publicly available and user-submitted data are added), the figure of your home value could be off by as much as 2%. On a $250,000 home, this can mean the difference of up to $5000!

Share this Image On Your Site

Why Accurate Home Values Matter:

- You could overpay for a house by nearly 10% – this could be as much as $30,000 on a $300,000 home.

- You might sell your house for less than it is actually worth – meaning that you leave money on the table.

How Your Online Home Value Is Calculated:

- The formula that online home-value calculators use is based on a certain set of criteria including square footage and location of your home.

- Data such as last sales date and sold price of your home is taken into consideration.

- Property taxes, exceptions to tax assessments, and other public property tax data are factored in.

- Comparable sales price, which is the recent sales prices of nearby homes, are used in the calculation (if available).

What Online Calculators Miss:

- Often times, the home values of an entire city or state may be factored in and not just the comparative values of houses in your immediate area.

- Online calculators miss the details of a home; i.e., what your house actually looks like. It cannot see whether you have done any renovations or upgrades that would increase the value of your home.

- If any data on your home or neighborhood is not correct, such as the price of the last sale, property tax info, or incorrect sales values of neighborhood houses, the online estimate will be off.

- If you live in a rural area, where sales are rare due to people staying in a home for a long period of time, the data can be even less accurate.

- Current market metrics, like the number of active listings that are direct competitors, are not accounted for.

Top 4 Reasons to Use A Realtor To Assess Your Homes Value:

- A realtor uses more than the hard, basic data, like the square footage, to assess your home. They look at your home through the eyes of a buyer, how it will be seen by an appraiser, and how the home needs to positioned against competition.

- A real estate agent is able to provide both an assessed value and a market value (the value your house will most likely be sold for in an open market) while an online calculator can only provide an estimated assessed value (often based on incorrect data).

- A realtor can assess the specific details of your property both positive & negative like backyard layout or whether your house sits next to a fire station or hospital which may be noisy.

- A realtor understands why it is important to price your home right; you don’t want your house sitting on the market for too long, nor do you want to undervalue the true value of your home.

Sources:

https://www.realtor.com/advice/sell/what-is-my-home-worth/

https://www.thesimpledollar.com/zillow-zestimate-vs-reality-how-much-is-my-house-worth/

https://www.thebalance.com/how-accurate-are-zillow-home-estimates-1798268

https://www.maxrealestateexposure.com/are-zillows-home-value-estimates-accurate/